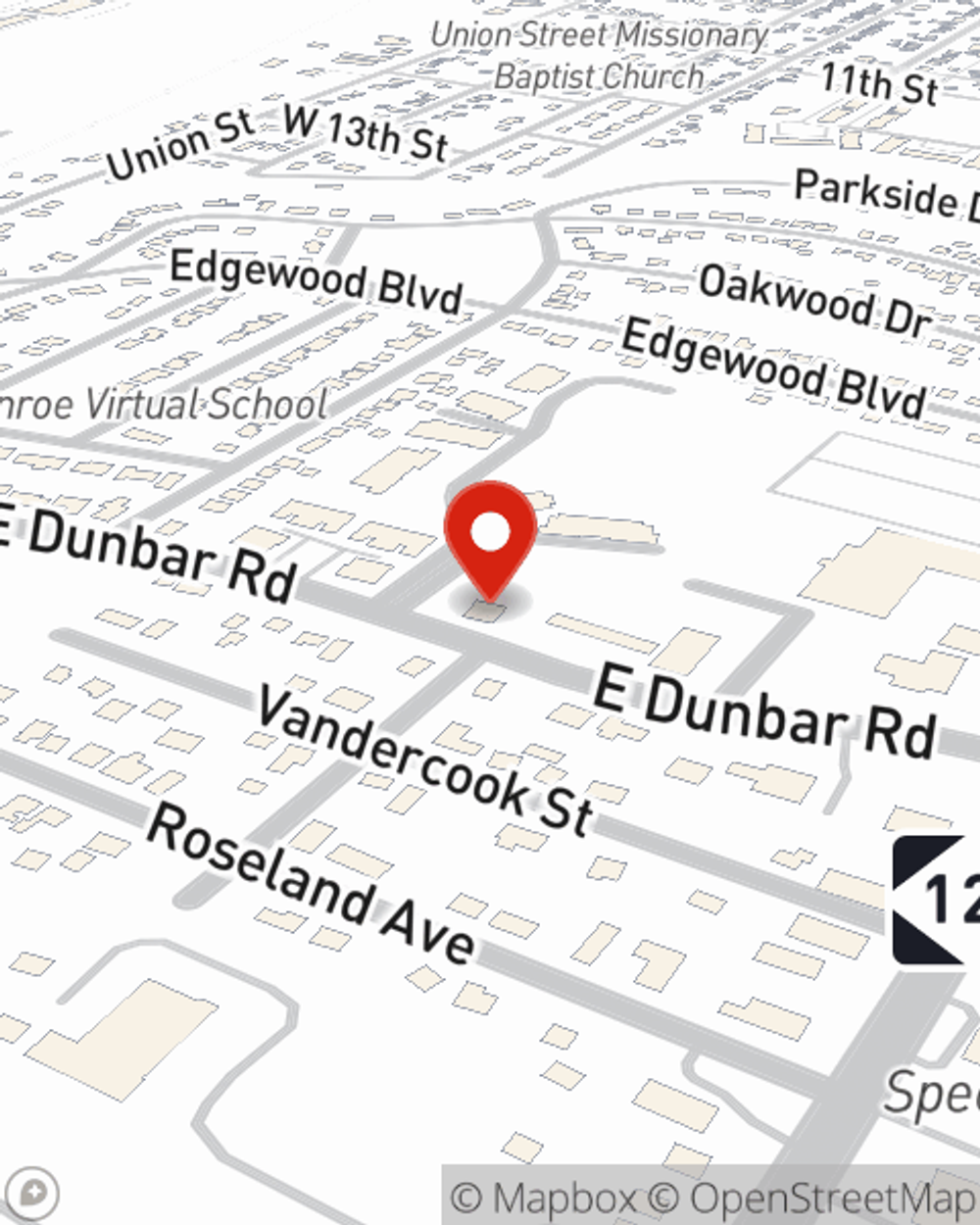

Life Insurance in and around Monroe

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

Choosing life insurance coverage can be a lot to consider with various options out there, but with State Farm, you can be sure to receive caring empathetic service. State Farm understands that your purpose is to protect the ones you hold dear.

Protection for those you care about

Now is the right time to think about life insurance

State Farm Can Help You Rest Easy

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Ben Torres stands ready to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

Looking for a life insurance option that even those who thought they couldn't qualify could benefit from? Check out State Farm's Guaranteed Issue Final Expense. It can be of good use to cover final expenses, such as medical bills or funeral costs, without burdening your loved ones. Contact your local State Farm agent Ben Torres for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Ben at (734) 457-5877 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.