Renters Insurance in and around Monroe

Renters of Monroe, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All Monroe Renters!

Think about all the stuff you own, from your smartphone to TV to books to lamp. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Renters of Monroe, State Farm can cover you

Rent wisely with insurance from State Farm

Why Renters In Monroe Choose State Farm

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Ben Torres can help you with a plan for when the unanticipated, like a fire or a water leak, affects your personal belongings.

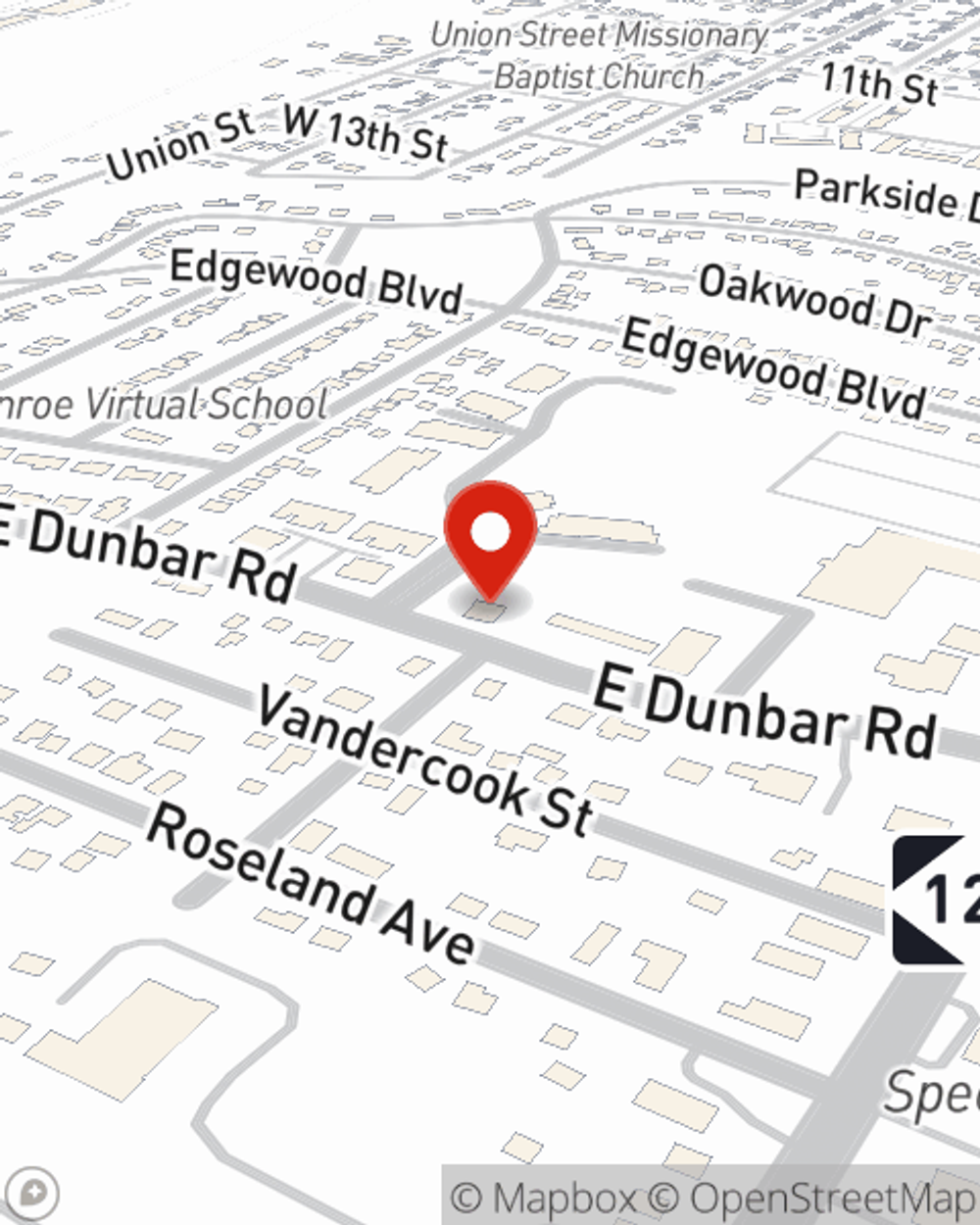

More renters choose State Farm® for their renters insurance over any other insurer. Monroe renters, are you ready to see how helpful renters insurance can be? Visit State Farm Agent Ben Torres today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Ben at (734) 457-5877 or visit our FAQ page.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.